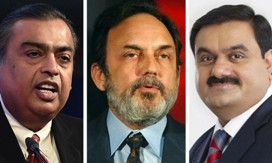

NDTV take over: Adani vs Ambani

SUBHASHIS MITTRA - Wide Angle

India's richest man Gautam Adani has launched a hostile bid to take over an influential broadcaster in India and gain a firmer footing in the country's vibrant media space.

The recent deal to take over the country’s popular NDTV television network has sparked concerns about the future of one of the media outlets prepared to criticise Narendra Modi’s government.

AMG Media Networks, a unit of billionaire Gautam Adani's conglomerate, said in a statement that it has acquired a 29.18% stake in New Delhi Television (NDTV) by buying one of the network's major shareholders for an undisclosed amount.

It has also set in motion an offer to NDTV shareholders to buy another 26% stake in the broadcaster for $61.77 million, according to filings by the Adani Group to the Mumbai stock exchange. Under Indian takeover regulations, the move triggers an open offer for a stake of another 26 and if that is successful, Adani would be left with a controlling stake of 55%.

"This acquisition is a significant milestone" for AMG Media Networks, Sanjay Pugalia, the CEO of the company said in a statement. The firm "seeks to empower Indian citizens, consumers and those interested in India, with information and knowledge," he added.

The coup has stunned the high-profile founders of the NDTV – founded in 1988 by journalists Prannoy Roy and his wife Radhika Roy -- which operates national channels in English and Hindi, along with a business channel and online news websites.

But the network revealed that it knew nothing about the takeover until Adani announced its move. “The NDTV founders and the company would like to make it clear that this … was executed without any input from, conversation with, or consent of the NDTV founders, who, like NDTV, have been made aware of this exercise of rights only today,” it said in a statement last Tuesday.

One of the nation’s most popular news organisations -- NDTV -- is regarded as one of the few media groups that takes a critical view of Modi’s BJP-led government policies. It is regarded as one of the most credible news networks in India and also one of the few major broadcasters that is often critical of Prime Minister Narendra Modi and the ruling Bharatiya Janata Party.

In contrast, Gautam Adani is a strong ally of Modi, who has been known to fly on Adani corporate jets.

Dipti Lavya Swain, founder and managing partner at DLS Law Offices, said: “From NDTV’s statements, it seems this may not be a friendly takeover which generally is as per agreed terms and mechanism, and in fact, may end up being a hostile takeover.”

The network is also the home of India’s most respected news broadcaster and anchorman, Ravish Kumar, who is also senior executive editor of NDTV. But one media commentator said that the takeover could see an exodus of personalities from NDTV. “NDTV was unabashedly pro-Congress and anti-BJP,” said author and media entrepreneur, Minhaz Merchant. “The Adani buyout will see an exodus of anchors and the channel will move editorially from left to centre.”

India’s TV news industry has a plethora of channels, 70 per cent of this market was dominated by Hindi news, according to a note by Elara Capital. Other than Ambani, the other big player is Times Group which runs many news channels and newspapers.

The takeover will also pit Adani against his billionaire rival, Mukesh Ambani, boss of the huge Reliance Industries group, which is already an established power in the country’s media sector through a controlling interest in Network18, which runs business channels including CNBC TV18.

In March, Adani, who has seen his wealth balloon in recent years thanks to investments in solar energy, made his first bet in the media sector by taking a minority stake in local digital business news platform Quintillion. But the proposed NDTV transaction marks Adani’s highest-profile media bet to date.

NDTV is the most suitable broadcast and digital platform to deliver on our vision,” Pugalia said.

While Adani did not disclose financial details of the group’s planned 29.18% stake purchase, it said its subsequent open offer would be for 294 rupees ($3.68) per NDTV share, which would be worth 4.93bn rupees. That open offer price is at a 20.5% discount to NDTV’s Tuesday’s close of 369.75 rupees.

Adani's move has sparked fears about shrinking editorial freedom and plurality in the world's largest democracy.

Prominent Indian media groups often have interests in other industries, according to a 2019 report by Reporters Without Borders (RSF), which said most of the leading companies are owned by "large conglomerates that are still controlled by the founding families and that invest in a vast array of industries other than media."

This means that TV channels and newspapers need to stay in the good books of the ruling party, and go easy on its failures, because their owners need favorable regulatory policies for their other businesses, experts say.

Adani, the founder of Adani Group, controls companies ranging from ports and aerospace to solar energy and coal. His fortune has grown exponentially since the pandemic started as investors bet on his ability to grow his business in sectors Modi has prioritised for development.

According to the Bloomberg Billionaires Index, Adani is currently worth $135 billion, making him the fourth richest man in the world.

However, the group's media foray comes at a time when its debt-fueled rapid expansion has become a matter of concern for analysts.